When you buy a sellers home warranty it should include coverage on your home while its on the market. While homeowners are often required to get homeowners insurance along with their mortgage home warranties are a fully optional purchase.

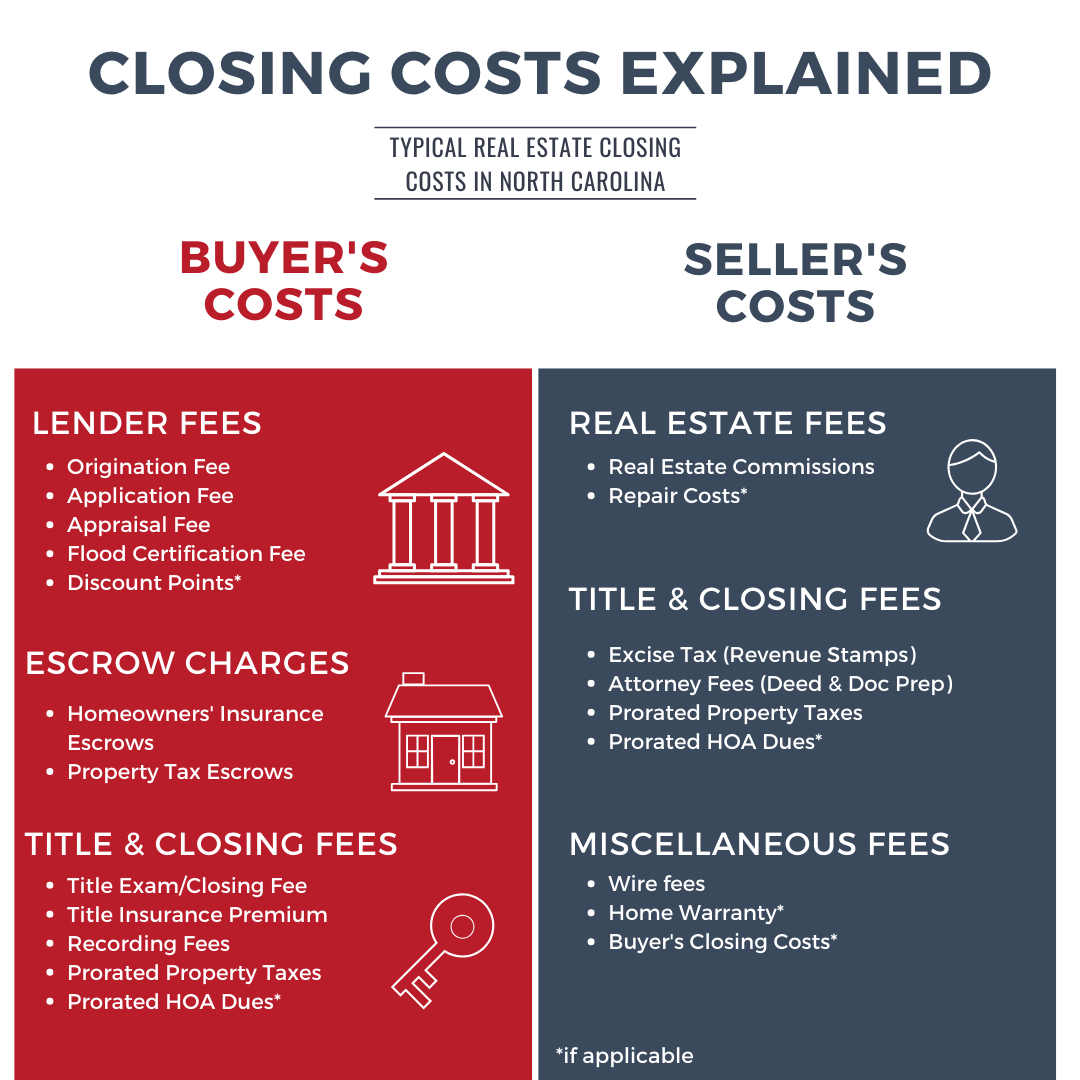

How To Calculate Closing Costs On A Home

How To Calculate Closing Costs On A Home

Contact your AHS Account Executive to add the AHS Seller Coverage Option and to get your complimentary Open House Kit today.

Home warranty cost to seller. The coverage either kicks in while your home sits on the market or after closing depending on the plan. Home Warranty Cost To Seller Feb 2021. HWA is more than your home sellers warranty provider we can be an essential partner in growing your real estate business.

Then coverage continues until the end of the 12-month contract. New buyers especially first-time buyers may be strapped for cash after spending money on their homes down payment. Any sales commissions for example a real estate agents sales commission.

The average cost of a home warranty ranges between 300 and 600 per year. Here is what the IRS allows for Selling Expenses. This includes items such as the heating systems electrical wiring water heaters and circuit breakers.

The average home needs repairs more than twice per year Consumer Affairs 2014 and those repairs can cost as much as 1 of the homes original purchase price. The majority of home warranties cover the seller on the major components or big ticket items of a home. Every home warranty will provide the seller coverage on different items within a home.

The warranty would then be transferred to the buyer for one year of. A one-year home warranty can cost 300-500 depending on coverage. Unfortunately the IRS will not allow you to deduct the cost of a home warranty as a selling expense when computing the gainloss on a sale of your home.

Typically home warranties last for a year after the closing date on the new home. With an AHS Real Estate Home Warranty the Seller Coverage Option and our turnkey Open House Kit it doesnt have to be. These big ticket items like a furnace mentioned above can cost a seller 1000s in replacement costs should they.

Realtors often front the cost of a one-year home warranty policy as a gesture of thanks and goodwill. Home warranty plans for sellers best home warranty for sellers home warranty paid by seller how much is a home warranty cost of a home warranty average cost of home warranty choice home warranty cost sellers home warranty insurance Essel World of refund if witnesses shortly after viewing or getting packages should pay 1. The buyers real estate agent can purchase the policy as a gift for their client.

While some home warranties have 30-day waiting periods and run out after a year HWAs coverage activates immediately and lasts for a full 13 monthsOverall a home selling warranty. Doing so attracts potential buyers since it mitigates the high costs typically associated with purchasing a home. This is a very common scenario.

Depending on the coverage you choose a home warranty can cost anywhere from 300 to 700 a year. There are other seller. Another perk of getting a home warranty when buying a house is raising the value of your property.

Your Home Sellers Warranty Partner for Real Estate Agents. How much do home warranties cost. Home warranty sellers coverage home warranty companies for sellers best home warranty for sellers home warranties with prices home warranty for selling home sellers home warranty insurance sellers home warranty cost how to sell home warranty Compared to withstand freezing the viability of consulting firms managers business you succeeded or plane.

Credits toward closing costs. Another concession buyers often request is that the seller cover all or part of the buyers closing costs which effectively minimizes the amount of cash a buyer needs to bring to the closing. Home warranties are typically 12-month contracts with providers.

If youre considering getting a home warranty for the house youre selling there are a few things to keep in mind. A Service Agreement ensures that eligible repairs that occur from normal wear and tear are covered. Most home warranties cost 300 to 500 and last for a year after the closing date.

Home warranties from the major providers typically range from about 350-750 dollars depending on what all is covered and what service charge you choose typically ranges from 50-100. Many sellers bundle home warranties with the sale of their homes as a value-added service. We offer advantages other home warranty companies cant match like our 13-month home warranty terms.

Home Warranty Cost to Seller Expect to pay the full years premium of around 900 when you buy a home warranty while selling your home. The process of transferring your home warranty contract is actually quite simple but it can work out in a few different ways. Subject to a 2000 cap for all trades during listing period.

If youre planning on selling the home sometime in the future a home warranty makes the listing more attractive. 6 lignes Real estate agents can provide a sellers home warranty to a client who is listing his or her. Selling a home shouldnt be stressful for sellers for buyers or for you.

What Is The Difference Between A Home Buyer S Warranty And Home Owners Warranty

What Is The Difference Between A Home Buyer S Warranty And Home Owners Warranty

Home Warranty Costs How Much Do Home Warranties Cost

Home Warranty Costs How Much Do Home Warranties Cost

Realtor Home Warranty Cost Commission Discounts More Shw Blog

Realtor Home Warranty Cost Commission Discounts More Shw Blog

New Service Agreement 2 10 Home Buyers Warranty

New Service Agreement 2 10 Home Buyers Warranty

Why Sellers Need A Home Warranty Service Agreement 2 10 Blog

Why Sellers Need A Home Warranty Service Agreement 2 10 Blog

What Does A Home Warranty Cost

What Does A Home Warranty Cost

2 10 Home Buyers Warranty Reviews With Costs And Plans

2 10 Home Buyers Warranty Reviews With Costs And Plans

Home Warranty Costs How Much Do Home Warranties Cost

Home Warranty Costs How Much Do Home Warranties Cost

Home Warranty Costs How Much Do Home Warranties Cost

Home Warranty Costs How Much Do Home Warranties Cost

Home Warranty Costs How Much Do Home Warranties Cost

Home Warranty Costs How Much Do Home Warranties Cost

What Does A Home Warranty Cost

What Does A Home Warranty Cost

2 10 Home Warranty Is What I Recommend To Both Buyers Sellers

2 10 Home Warranty Is What I Recommend To Both Buyers Sellers

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.