Total Weekly Benefit. However unemployment benefits received in 2020 are exempt from tax.

Claimant Most Frequently Asked Questions Division Of Unemployment Insurance

Claimant Most Frequently Asked Questions Division Of Unemployment Insurance

These rates of course vary by year.

How much is unemployment in md. By law unemployment compensation is federally taxable and must be reported on a 2020 federal income tax return. UPDATE On May 7 a spokesperson with Sagitec said eligible PUA and. Wage Base and Tax Rates In recent years Maryland has required UI taxes on the first 8500 of each employees wages.

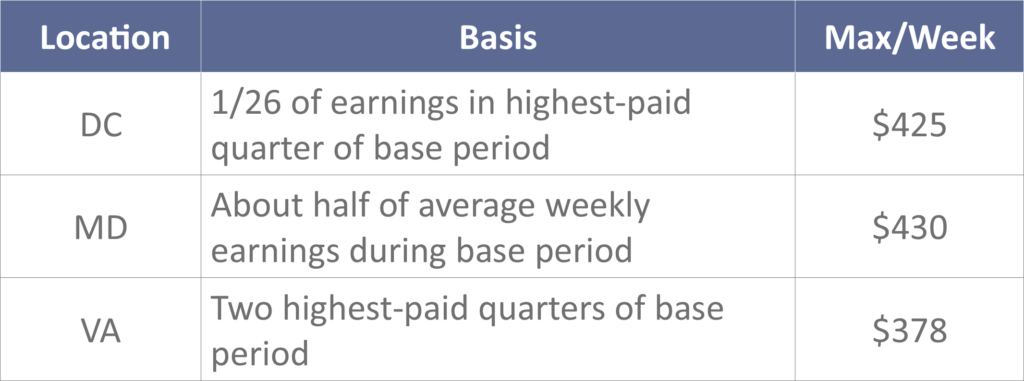

In Maryland unemployment amounts range from 50 to 430 per week. The Lost Wages Assistance supplemental payments of 300 paid for weeks. The least you can receive is 50.

Calculate your Weekly Benefit Amount WBA by dividing your gross wages for the base period by 52 to find your average weekly salary. This calculator uses the average weekly state benefit amount reported by the Department of Labor from Jan 2020 to. Total Weekly Benefit.

However that amount known as the taxable wage base could change. The benefit is retroactive to the week beginning March 29 2020 and the program expired the week of July 25 2020. The UI tax rate for new employers is also subject to change.

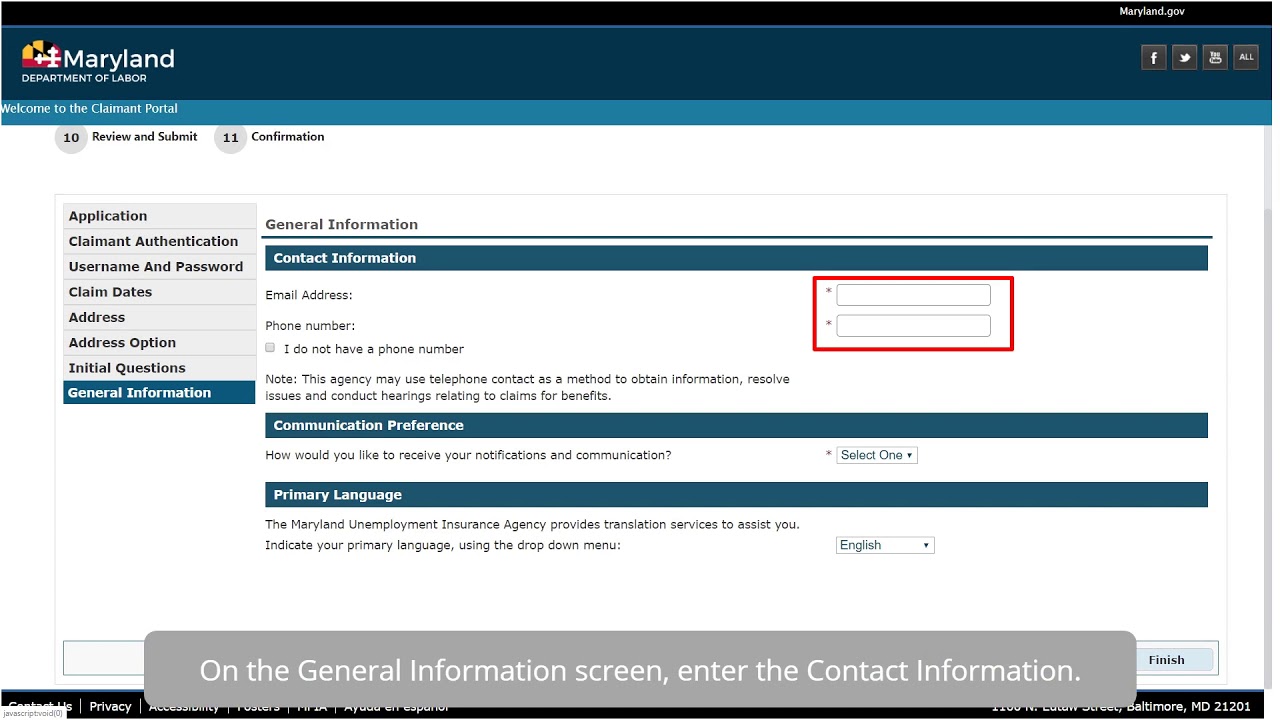

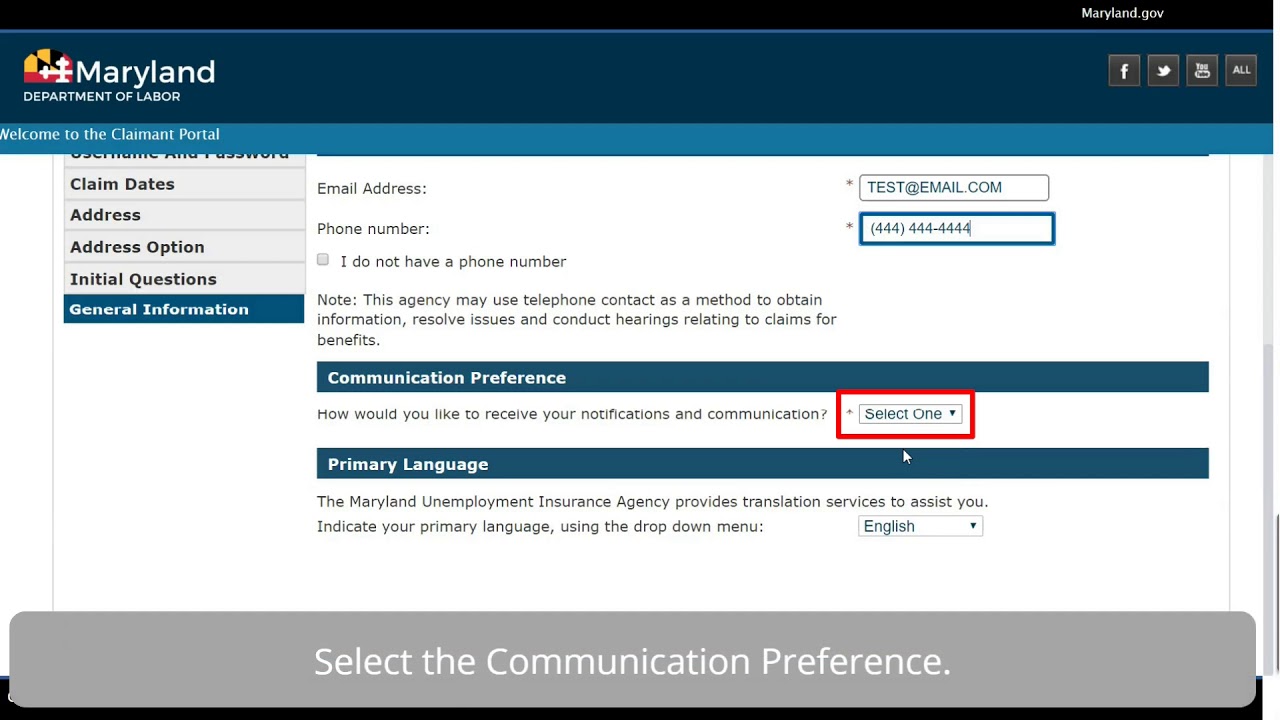

The weekly benefit amount WBA is the amount of money you may receive and for regular UI is based on the amount that you were paid by all employers in the last 18 months. And last updated 707 PM Mar 17 2021. In times of very high unemployment federal and state programs may make additional weeks of benefits available.

54 Zeilen It provides an additional 600 per week in benefits and payments through. Pandemic Unemployment Assistance PUA. Maryland State Unemployment Tax For 2021 Marylands Unemployment Insurance Rates range from 22 to 135 and the wage base is 8500 per year.

State Taxes on Unemployment Benefits. Taxable benefits include any of the special unemployment compensation authorized under the Coronavirus Aid Relief and Economic Security CARES Act enacted last spring such as PUA PEUC and FPUC. The range of unemployment compensation in Maryland varies from 50 to 430.

BALTIMORE Maryland workers who have gone nearly two months without any income should receive unemployment benefits this week according to the vendor tasked with creating the states new claims website. Anyone eligible for unemployment insurance in Maryland can receive at least 50 a week. How much money can I receive and how is my weekly benefit amount WBA determined for regular unemployment insurance benefits.

In addition the RELIEF Act provides 1000 Unemployment Grants to 32000 recipients. This calculator uses the average weekly state benefit amount reported by the Department of Labor from January 2020 to November 2020 to. State Income Tax Range.

Provides an additional 300 per week for claimants who receive at least 1 in benefits under another unemployment insurance program. Unemployment Compensation for Federal Employees UCFE. People generally receive about half of gross weekly wages up to a maximum of 430 a week.

Adds 600 per week and the regular benefits recipients of Unemployment Insurance are entitled to receive. Unemployment Compensation for Ex-Servicemembers UCX. This is the amount of partial unemployment benefits payable for the week.

For Marylanders who received or currently receive UI benefits the RELIEF Act provides an income tax subtraction for Tax Years 2020 and 2021. Posted at 213 PM May 06 2020. You can look up your exact benefit amount on Marylands Schedule of Unemployment Benefits The most you can receive per week is currently 430.

Divide this by two to get an approximation of your WBA. Maryland is able to offer the 13 week Extended Benefits program because it met the federally mandated requirement that Marylands insured unemployment rate IUR exceed 50 percent and be at least 120 percent of the corresponding average rate in the prior two years. Federal Pandemic Unemployment Compensation FPUC.

Unemployment compensation is usually taxed in Delaware. You may receive benefits for a maximum of 26 weeks. The current WBA in Maryland ranges from a minimum of 50 to a maximum of 430.

500 and less than 32 hrs of work 3013 wages over 30 Wyoming. After filing a weekly claim you will receive your benefits on a state-provided debit card. Pandemic Emergency Unemployment Compensation PEUC.

The higher your earnings the higher your WBA will be up to the maximum amount allowed by law. Your weekly benefit amount will be reduced when your earnings exceed half of your weekly benefit amount.

Unemployment Benefits Expanded But Jobless Workers Unable To Apply

Unemployment Benefits Expanded But Jobless Workers Unable To Apply

Labor Says It Has Paid 327k Unemployment Claims During Coronavirus Pandemic

Labor Says It Has Paid 327k Unemployment Claims During Coronavirus Pandemic

Division Of Unemployment Insurance Maryland Department Of Labor

Division Of Unemployment Insurance Maryland Department Of Labor

Questions About Maryland Unemployment We Have Answers

Claimant Most Frequently Asked Questions Division Of Unemployment Insurance

Claimant Most Frequently Asked Questions Division Of Unemployment Insurance

Division Of Unemployment Insurance Maryland Department Of Labor

Division Of Unemployment Insurance Maryland Department Of Labor

![]() Maryland Unemployment Benefits System Was Not Ready For Volume Wtop

Maryland Unemployment Benefits System Was Not Ready For Volume Wtop

Division Of Unemployment Insurance Maryland Department Of Labor

Division Of Unemployment Insurance Maryland Department Of Labor

Division Of Unemployment Insurance Maryland Department Of Labor

Division Of Unemployment Insurance Maryland Department Of Labor

Division Of Unemployment Insurance Maryland Department Of Labor

Division Of Unemployment Insurance Maryland Department Of Labor

Am I Eligible For Unemployment Alan Lescht

Am I Eligible For Unemployment Alan Lescht

Division Of Unemployment Insurance Maryland Department Of Labor

Division Of Unemployment Insurance Maryland Department Of Labor

Unemployment In The Washington Area By County June 2020 Mid Atlantic Information Office U S Bureau Of Labor Statistics

Unemployment In The Washington Area By County June 2020 Mid Atlantic Information Office U S Bureau Of Labor Statistics

Division Of Unemployment Insurance Maryland Department Of Labor

Division Of Unemployment Insurance Maryland Department Of Labor

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.